How to Get Started in Real Estate Investment With No Experience (Collaborative post)

Jumping into real estate investment with little to no experience might seem like a huge challenge, but it’s easier than most people think when they take it step by step. It’s not just for wealthy business people or financial experts either.

With the right mindset, some research, and a willingness to learn, anyone can get started and work toward financial success. Real estate has created wealth for millions of people, and it can do the same for those who take the time to understand how to make smart decisions. There’s no need for a business degree or a massive budget, just patience and a strong plan.

So let’s take a look at some of the most important things that you need to know if you’re looking to get started in real estate investments.

Understand the basics of real estate investing

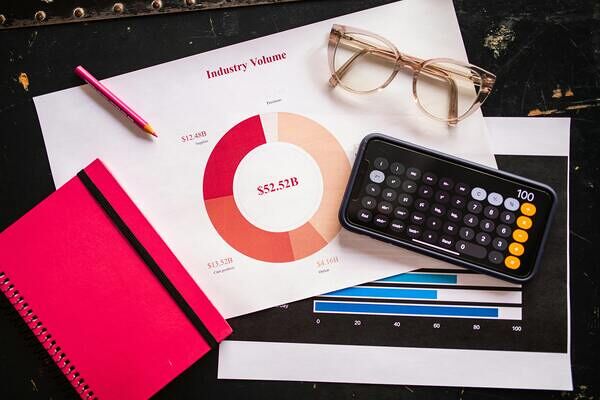

Before putting money into a property, it’s important to understand how real estate investing actually works. There are different ways to invest, and each comes with its own risks and benefits. Some people buy homes to rent out, while others purchase properties to fix up and sell for a profit. There are also those who invest in real estate without owning physical property, like through real estate investment trusts.

Real estate values go up and down based on the market, which is why it’s important to do plenty of research before making a decision. Paying attention to market trends, interest rates, and local property demand helps investors make smarter choices. A rental property in a growing area could be a great long-term investment, while buying a cheap house in a declining neighborhood might be risky.

Understanding real estate investing also means knowing the costs that come with owning property. Many beginners focus only on the purchase price, but there are other expenses like property taxes, maintenance, insurance, and unexpected repairs that can quickly add up.

Rental properties, for example, may sit vacant for a few months between tenants, which means there won’t be any rental income during that time. Investors should always budget for these extra costs and have a financial cushion to avoid stress when things don’t go exactly as planned.

Set clear goals and create a strategy

Jumping into real estate investment without a plan is like going on a road trip without a map. Before buying anything, investors should set clear goals based on what they want to achieve. Some people want to build long-term wealth, while others are looking for a way to make extra cash more quickly. The right strategy depends on personal finances, time commitment, and risk tolerance.

For those looking for steady income, rental properties are a great option. They bring in money every month and grow in value over time. House flipping, on the other hand, can be profitable but also risky because it depends on making quick, smart renovations and selling at the right time. Deciding on a strategy makes the investment journey smoother and helps avoid costly mistakes.

Start small and build knowledge along the way

Real estate investing doesn’t have to start with a million-dollar property. Many successful investors begin with something small, like a single rental home, a duplex, or even a fixer-upper that they can live in while making improvements. Starting small helps limit risks and allows beginners to gain experience without feeling overwhelmed.

Learning should never stop in the real estate world. Reading books, watching videos, and listening to experts can provide valuable knowledge that helps investors make better decisions. Talking to experienced investors, attending local real estate meetups, and asking professionals for advice can also be extremely helpful. The more knowledge an investor gains, the more confident they become in making the right choices.

https://unsplash.com/@schluesseldienstvergleich_eu?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash

Secure financing and manage money wisely

One of the biggest concerns for beginners is figuring out how to afford an investment property. While some people save up for years, others look for creative financing options to get started sooner. Loans, private lenders, and partnerships are some ways that investors find the money to buy their first property. Some even use a strategy called "house hacking," where they live in one unit of a multi-family property while renting out the others to cover their mortgage.

Managing money wisely is just as important as securing financing. Unexpected costs, repairs, and market downturns can create financial stress, so having extra savings is always a good idea. Budgeting for maintenance, property taxes, and potential vacancies helps investors avoid major financial headaches. Being prepared for the unexpected makes the investment journey smoother.

Choose the right location for investment

The success of a real estate investment often depends on location. Some areas grow in value over time, while others struggle due to job losses, poor schools, or high crime rates. Before buying a property, investors should study the local market to see if it's a good place to invest. Researching job growth, population trends, and neighborhood development can help identify strong investment opportunities.

A cheap property might seem like a great deal, but if it’s in an area where nobody wants to live, renting it out or selling it later could be difficult. On the other hand, properties in high-demand areas are more likely to attract tenants and grow in value. Finding a balance between affordability and future growth potential is key to making a smart investment.

Work with professionals and build a strong team

Even the most experienced investors don’t do everything on their own. Building a strong team of professionals can make real estate investing much easier and more successful. A good real estate agent, an honest contractor, and a reliable property manager can help investors avoid costly mistakes and make smarter decisions.

A real estate service provider can also be helpful when looking for financing, legal guidance, or market insights. These professionals have experience in the industry and can offer valuable advice that makes the process smoother. Investors who surround themselves with knowledgeable people increase their chances of making profitable investments.

Start real estate investing as a side hustle

Not everyone has the time to fully commit to real estate right away. Many people begin their journey as a side hustle while working a regular job. Investing part-time allows beginners to learn, make mistakes on a smaller scale, and gradually build wealth over time.

Some start by renting out a spare room, investing in a small rental property, or even partnering with someone who has more experience. The key is to take small, manageable steps instead of rushing into big financial commitments. As confidence grows, real estate can become a full-time income source for those who want to take it further.

https://unsplash.com/@fromitaly?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash

Learn how to market and attract tenants

Finding the right tenants is just as important as buying a good property. A rental property only makes money when people are living in it and paying rent on time. Advertising on popular rental websites, using social media, and asking for referrals from friends or family are good ways to find tenants.

Screening tenants carefully is also necessary to avoid problems. Checking credit history, rental background, and employment status can help landlords choose renters who are responsible. A good tenant is more likely to pay rent on time and take care of the property, which saves money and stress in the long run.

Stay patient and don’t expect quick success

Real estate investing is not a get-rich-quick scheme. It takes time to see results, and patience is often the key to success. Some people buy a property and expect to make huge profits right away, but in most cases, real estate grows in value slowly. Holding onto properties and allowing them to appreciate over time can lead to much greater financial rewards.

There will be challenges along the way, and mistakes will happen, but every experience provides an opportunity to learn. Those who stick with it, adapt to changes, and keep improving their strategies are the ones who find long-term success in real estate investing.

Know when to expand and grow a portfolio

After successfully investing in one or two properties, many investors start thinking about expanding their real estate portfolio with more. Owning multiple properties can increase income and create more opportunities for long-term wealth, and it’s the most common way to scale things up. However, growing too quickly without proper planning can lead to financial struggles.

Expanding should be done at a pace that feels comfortable and manageable. Some investors reinvest their rental income into buying more properties, while others wait until their first investment is fully profitable before moving forward. Being cautious and thinking ahead helps prevent unnecessary stress and financial strain.

Getting started in real estate investment with no experience takes patience, research, and a willingness to learn. Taking small steps, working with professionals, and choosing the right strategy can help new investors build wealth over time. There’s no need to wait for the perfect moment. The best way to get started is by taking action, learning from mistakes, and growing along the way.